A Potential Shift in the Interest Rate Cycle?

It seems that there has been a change of sentiment when it comes to economic conditions lately. The era of ultra-low global interest rates environment is being debated. Both lagging and leading indicators in some of the major economies have been providing mixed messages. Global inflationary pressure has been recently in the forefront of central banks agendas and the driving force behind much of the argument around monetary policy normalization.

The latest Consumer Price Index (CPI) reading, for the month of October, showed a 6.2% year-over-year increase in prices in the U.S. which is significantly higher than the projected 5.8%, as well as September’s 5.4%. This annual reading was the highest since December 1990. In the Eurozone, annual inflation for the same month came in at 4.1%, which is the highest since July 2008. In the UK, October inflation reading was standing at 4.2%, up from 3.1% in September and represents a 10-year high. These are attention-grabbing readings. Yet many argue that rising inflation reflects temporary pandemic-related supply-demand mismatches and higher commodity prices compared to their low base from a year ago. Nevertheless, by using alternative measures of inflation (Core CPI, 24 months period inflation, etc.), many analysts have suggested that there is more to this surge in prices than indicated and inflation this year will likely persist into 2022.

As for the U.S. jobs market, the unemployment rate fell to 4.6%, the lowest level since May 2020. More than 18 million jobs have been added back since the economic recovery started. Still, such a number remain 4.2 million jobs below pre-pandemic level. In early November, the Federal Open Market Committee (FOMC) announced its highly anticipated asset purchase reduction program, and treasury yields across the curve dropped from the recent highs seen in late October as market’s expectation of Fed rate hikes in the first half of next year has lessened. But high interest rates volatilities had continued mainly derived by prospects of higher inflation. Currently, expectations for the first increase in the Fed target range have moved forward to July 2022 with the market currently expecting two 25 basis point rate hikes in 2022. There remains, however, a strong element of uncertainty. This article has been written as a new variant of Covid (Omicron) emerges, with early cases being reported in South Africa. This may add further doubt about future economic growth, and interest rates outlook.

Bahrain

To preserve monitory stability, the central bank would need to effectively maintain the Dollar/Dinar exchange rate within the framework of the pegged exchange rate regime. Hence, local interest rates tend to be influenced by its U.S. counterparts. Local liquidity factors play a role too. In light of that, local rates had remined relatively low, where the 3 months Bahraini Dinar Interbank Offered Rate (SAIBOR) had averaged at around 87 basis points since Q1 last year.

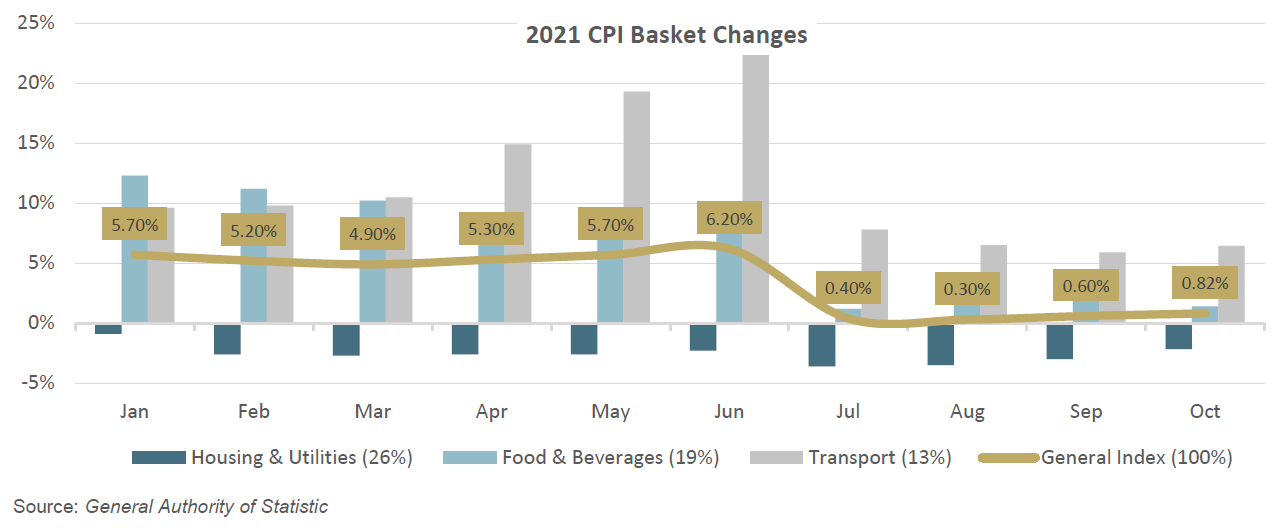

Recently, there have been plenty of developments that could change the economic narrative of the pandemic era. According to official reports, the Kingdom’s real GDP, buoyed by the non-oil sector, is expected to grow by 2.6% in 2021 and 7.5% in 2022. Inflation (measured via CPI) is expected to stand at around 3.3% in 2021 and 1.3% in 2022. Yet, annual inflation has largely dropped since July this year averaging at circa 0.5% up until October as the base year effect of raising the value-added tax fades-out. Covid has been under control so far with relatively few new cases and high immunization rate.

Daily production of oil continues to grow since June 2021 and prices per barrel has been averaging closer to $70 in the last 12 months. The Ministry of Finance (MoF) has upwardly revised Bahrain’s fiscal outlook for 2021 and 2022. The government debt is expected to grow by SAR 83 billion in 2021 and SAR 52 billion in 2022 which represents 30.2% Debt-to-GDP ratio in 2021 and 31.3% in 2022.

COST OF HEDGING

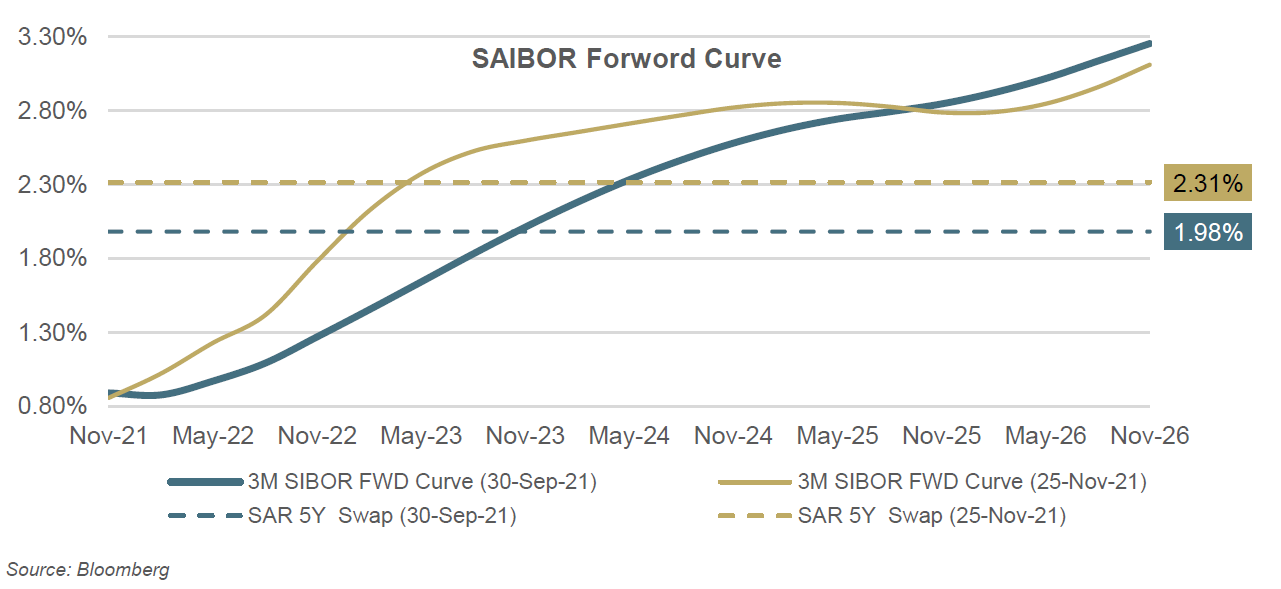

Generally, interest rates are relatively low at the beginning of an economic expansions, but they usually tend to rise as the economy grows. To start, let us first look at the developments in the Bahraini Dinar interest rate forward curve as it projects the expected future floating-rate cash flows used to calculate the fixed rate in an interest rate swap. The position, steepness, and volatility of the forward curve are the key factors that determine the price of interest rate derivatives.

By looking at the chart above, it takes paying roughly 2.31% to hedge a given SAR bullet notional for five years by late November as opposed to 1.98% at the end of September via an interest rate swap. An increase of 33 basis points is not necessarily something out of the ordinary in the local swap market, but rather the relevant speed of which expectations have changed is what worth noting. Similarly, for an at-the-money interest rate cap, implied volatilities over the period covering the next five years have increased on average by around 17 basis points. This is a staggering average increase of 63% across the five-year curve in less than two months. Compared to late November, the same can be said for Q2 and Q1 of this year, as volatilities increased by around 28% and 31%, respectively.

Implied volatilities represent the expected volatility of the underlying index (SAIBOR) over the life of the cap. They are an integral component in making up the premiums of these options. As expectations change, option premiums react appropriately. All levels are as of the time of writing and are subject to change as per market developments.

PLAN AHEAD

Interest rate risk management is not purely about controlling the interest line in the profit and loss statement. It also engulfs the management of the entire debt profile of the business, including its maturity, currency, the fixed-floating mixture of the debt and expectations of future interest rates. Accordingly, corporate borrowers should have a clear understanding of some of the key elements impacting their desired risk profile.

A possible shift in the interest rate cycle can have significant implications on a business profitability and growth. It requires some basic knowledge around an entity risk appetite, debt portfolio structure, duration, cash flow timing, and interest rate sensitivity. Also, being aware of assets that can create an offsetting effect, such as stable and core cash that can be invested, would potentially optimize hedging activities. In other words, by looking at the net debt position as opposed to absolute debt, off-balance sheet hedging (i.e., via derivatives) may possibly be confined. This in turn would reduce its associated cost.

In this article, we have seen how the cost of hedging can shift as the economic sentiment and rates outlook changes. It is therefore helpful to understand the different ways a hedging program can be effectively implemented. Strategies that take into consideration the increasing cost of hedging, yet at the same time, maintain an entity’s financial risk management objectives are the ones worth pursuing. As a rule of thumb, all hedging activities should be objectively justified and thus have a direct impact on an entity KPI(s).