Overview of Commodity Risk Management

The COVID-19 pandemic induced supply chain disruptions have impacted commodity prices dramatically. This has prompted traders and treasuries worldwide to assess their policies for managing commodity price risk.

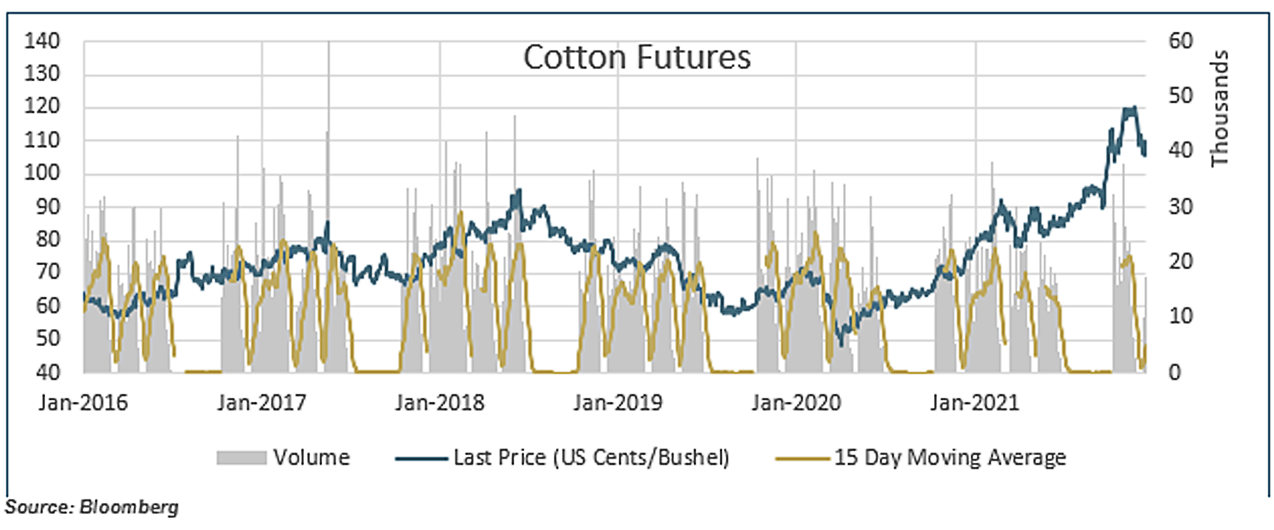

Most governments had to shut down their economies due to the pandemic post March 2020. This caused production to come to a standstill and commodity prices to surge. While the prices for most commodities fell in the short term, to absorb the shock from the pandemic, the trend of an upsurge in prices can be easily observed.

Commodities differ from the other asset classes because they are tangible resources and require storage. Storage is usually bought for a limited period and can be expensive, and the price of storage can also play a major factor in the price of the commodity itself. To gain an idea around the importance of storage, in early 2020 the pandemic caused the global demand of oil to plunge, and the price of WTI crude oil futures became negative, since at the time oil price fell to such a level that it was more expensive to hold oil than to sell it. Similar effects were observed in other commodities such as corn and cotton as well. This is known as ‘storage risk’ and is an acknowledgement to the fact that more care needs to be given when dealing with commodities.

Commodities are subject to other risks as well. Prices of most commodities have an element of seasonality within them, which means that there is a pattern of price rise and fall at particular times during the year. As mentioned before, the storage risk needs attention as well. The seasonality component is due to the supply and demand of the commodity having set patterns for increase and decline.

Similar to other classes of securities, commodities are traded frequently on financial markets and can be spot traded or have their derivative traded on the market. Derivatives on commodities include futures, forwards, swaps, and option contracts on these commodities.

These derivatives are traded on the exchange (for example the Chicago Mercantile Exchange (CME) or over-the-counter (OTC)). As with the other asset classes, these derivatives primarily exist to protect holders or producers of the commodity from price fluctuations and to stabilize their projected earnings and cash flows.

Even within Bahrain, we see multiple local banks offering OTC tailored solutions, but the underlying asset class determines the depth and characteristics of the instrument.

Commonly traded types of commodities:

Agricultural commodities – this group includes goods that are grown or farmed, such as corn, wheat, soybeans, coffee, cotton, etc. The prices of these goods usually increase or decrease in a seasonal pattern and mean-reversion is usually inherent in their price.

Metals – this group consists of gold, silver, platinum, copper, aluminum, etc. Prices for these goods are not seasonal and usually do not follow mean-reversion. A subset of this group is the precious metals, which include gold, silver, and platinum, and these commodities are usually held for investment purposes as well.

Energy Products – energy commodities are crude oil, heating oil, natural gas, and electricity. Among all commodities, the crude oil market is the largest globally, with demand being close to 100 million barrels per day. Their prices are usually assumed to follow a mean-reverting process.

An unusual commodity that comes under the umbrella of energy commodities is electricity. It is considered uncommon since it cannot be stored. However, derivatives contracts exist on electricity, such as power futures that are traded on NYMEX.

Market risk management has become commonplace in most firms around the globe; however, the focus is usually around the management of risks from interest rate and foreign exchange fluctuations. More emphasis is required on the consequences of commodity price risk and EBITDA fluctuations arising due to inventory price movements. A comprehensive risk management strategy at the firm level that utilizes all options available is recommended to manage EBITDA margin volatility and betting on the markets is not advised. It is also prudent to match inventory volume to supply and demand and collaborate with the sales/operations department to identify and quantify such risks.

Additionally, while the operations department usually handles the procurement of the underlying commodities, risk management and financial hedging is typically performed within the treasury. This means that the firm must employ policies and procedures, along with an appropriate accounting treatment to align the consideration of commodities between these two departments.

Commodity related considerations

Cost of carry – This refers to the expenses a firm incurs on account of holding commodities in their inventory, such as storage costs, insurance, and antiquation.

Convenience yield – Opposite to the cost of carry, the convenience yield is the premium associated with holding an inventory. In case of an inverted market or scarcity, holding the commodity becomes more beneficial than buying it in the futures market.

Basis risk – Basis is the difference in the price of the physical commodity and its future price. Basis risk is the possibility of the price of the commodity and its futures not moving in a correlated manner. Proxy hedges are adopted to manage basis risk and work by hedging a contract of one quality or in one market with a contract of a different quality or in another market. For example, using gas oil or heating oil to hedge against jet fuel.

Contango and backwardation – Contango is the normal market condition, i.e., the futures price is higher than the spot price. This is observed in mining commodities such as gold, and in this case, the basis is negative. Backwardation is the opposite. Here the price of the futures contract trades below the spot price, and the basis is positive. This happens for agricultural commodities in the event of shortages.

Commodity Risk Management

Commodity risk management should be given equal importance within a firm’s risk management policy as the interest rate, and foreign exchange risk management as the price fluctuation of commodities within the inventory can have a considerable impact on earnings if not properly managed.

The risks associated with commodities are detailed below:

Price Risk – This refers to an unfavorable movement in the price of the commodity caused by macroeconomic factors.

Quantity Risk – This is the risk related to the changes in the availability of the commodity.

Cost Risk – Cost risk is the risk of an increase in the costs of services due to demand and supply and can impact business costs.

Regulatory risk – Regulatory risk is also called political risk and refers to the risk of new laws or regulations that affect the price of the commodity.

As mentioned earlier, storage risk is another risk that can affect the firm’s earnings. It is worth noting that in the case of certain commodities, especially essential foods, many producers are not permitted to increase the price on account of government regulations. This means that the control of this risk and cost becomes much more significant. The risk to a firm from commodity price fluctuations needs to be assessed from the firms’ operations and can vary depending on whether the firm is a commodity trader, buyer, seller or holds certain commodities in its inventory for use towards the production of other goods.

A commodity risk management strategy involves a comprehensive framework that includes the frequent monitoring of price changes, identification of the risks involved, quantification of the risks and applying an appropriate hedge strategy. From our observation of the local markets, the relationship between the supplier and procurer, and the contractual obligation of the party responsible for absorbing the cash flow timing risk is the first thing to consider when advising for managing commodity risk. The nature and operations of a firm define the extent to which it will be exposed to commodity price risk, and so a unique hedge strategy needs to be implemented to protect the firm’s earning from being affected by price swings.

Due to the unique nature of the commodity asset class, there are additional considerations that need to be assessed in the modelling of commodity prices. Additional modeling elements are employed to make it a better fit for estimating future commodity prices. Components such as time-dependent drift factors, seasonal factors, and Poisson processes can be incorporated into the model to manage mean-reversion, seasonality, and jumps in the commodity prices, respectively, based on the nature of the commodity. Over time, more sophisticated models have been developed for the use of forecasting oil prices. Some of the features of recent models include the use of convenience yields and stochastic volatility.

It can be clearly observed in recent times that markets remain volatile and inhospitable. Treasurers are exposed to market risks, whether it be from interest rates, FX, or commodities. It can be easily perceived that a robust risk management framework is essential to a firm’s success. A pro-active approach towards hedging can protect against a decline in earnings, and at the same time, contribute to staying ahead of the competition. The path towards risk management involves deep analysis and sound measurement, and the onus is on the firm to employ comprehensive risk mitigation policies.