Boosting Commodities Risk Management Amid Uncertainty

Just as the global economic systems began to recover from the impact of the COVID 19 pandemic, another crisis hit. In late February, Russia initiated its invasion of Ukraine, boosting the uncertainty in the markets and adding more tension to already strained economic systems. To top it up, the inflation pressures in the west have left officials scrambling to tighten monetary policies. The US Federal Reserve have raised rates for the first time since 2018 and indicated to the world that further rate hikes would be coming.

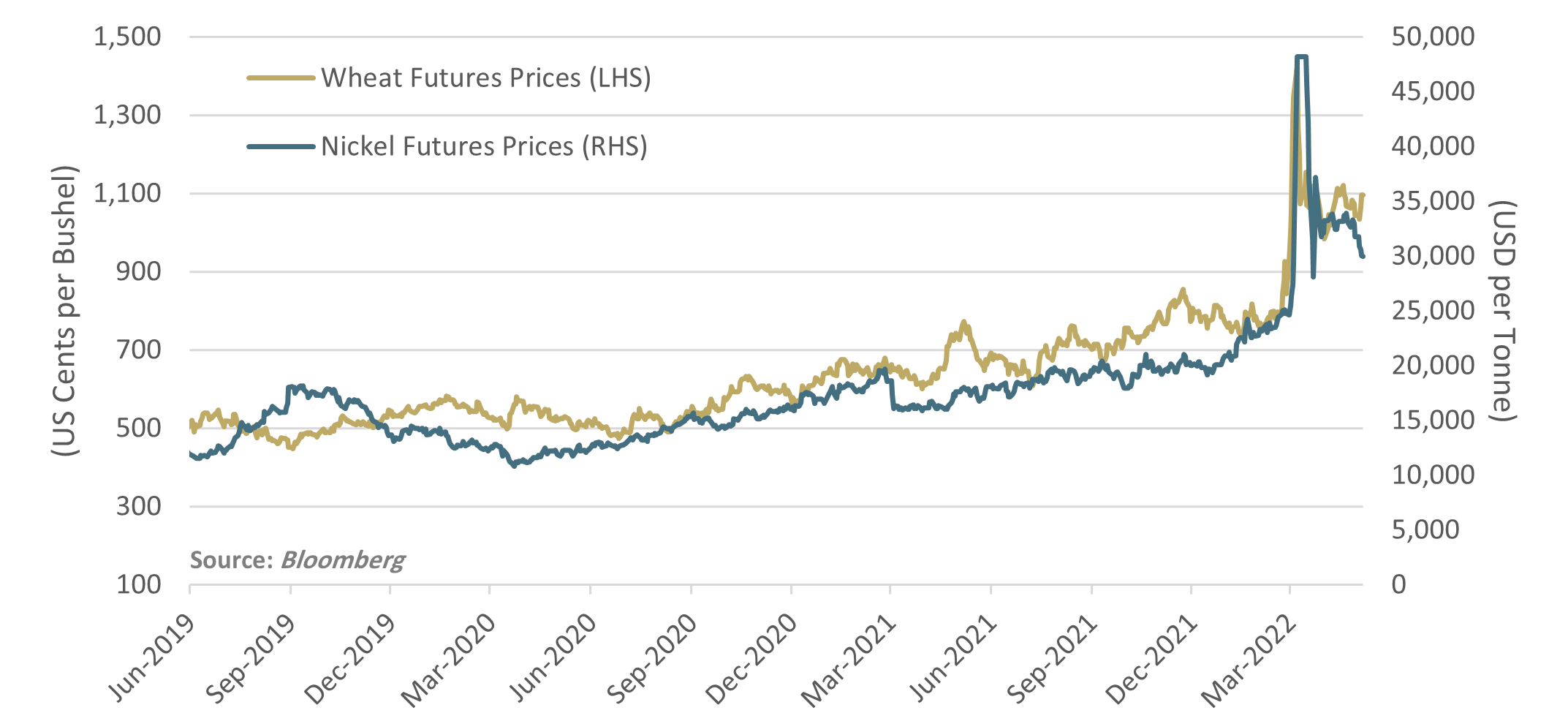

On the day of the conflict, prices spiked markedly as unpredictability around the availability of these commodities arose. While prices corrected following the panic buying, they remain higher than their pre conflict levels, and the consensus in the markets is that the uncertainty is here to stay.

Volatility in the markets has increased significantly in response to the uncertainty. The chart below shows how commodity prices have been reacting to the current conflict. Both counties involved in the conflict are major exporters of agricultural commodities (like corn and wheat), energy commodities (like oil and natural gas) and minerals (like platinum and nickel).

The latest conflict has fueled further the supply chain disruptions caused by the pandemic. This has led to an increase in inflation pressures, particularly in the west. U.S inflation numbers recorded for March at 8.5% was the highest they have been in four decades. These events have highlighted the importance of having a rigorous risk management framework. Additionally, firms must also reassess this framework to ensure that it serves the purpose of protecting the firms from such unforeseen events.

While employing risk management and mitigation strategies should be approached neither with the intention of speculation nor with the fear of market movements in the future, it is vital to recognize that these extraordinary events do happen and can impact firms harshly. This holds true, particularly for firms that have exposure to commodities, as the current times demonstrate that logistical issues can negatively affect a firm’s operations.

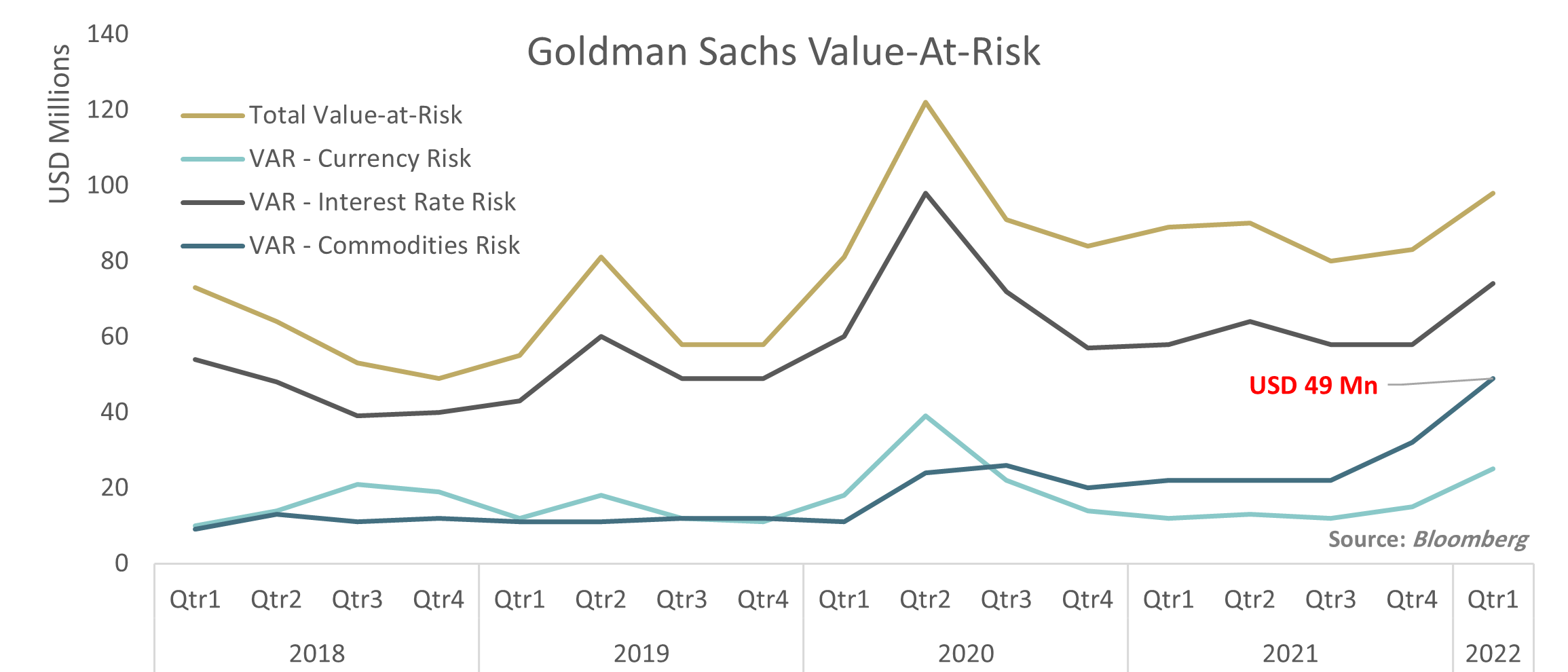

Risk management is built around the quantification of risk using various measures and then taking adequate actions to mitigate that risk. The most popular measure used for quantification in financial risk management is the Value-At-Risk (VaR), which measures the maximum loss in the value of a portfolio over a predetermined time period for a given confidence interval. The wide use of VaR is a result of its flexibility and ease of use. Various regulatory bodies also use the VaR measure to set banks’ market risk capital requirements.

Impact of the COVID pandemic (2021) and Russia-Ukraine conflict (2022)

Most banks and firms use the VaR measure, and some even report it in their financial statements. As can be expected, heightened volatility in the markets impacts this quantification of risk. Additionally, the VaR measure can serve as the platform for stress tests by regulatory bodies to establish capital requirements, particularly for banks. Following are a few examples of how governments and financial institutions have been impacted by the events in the past few years:

VaR breaches – Top US banks recorded multiple VaR exceptions during their back testing exercises for the last quarter of 2021. This was even before the Russia-Ukraine conflict began. The steeply rising commodity prices point to expectations of further breaches in VaR for these banks in the coming months.

Fed’s severe stress test – The Federal Reserve announced markedly stringent conditions for banks’ stress-test scenarios for 2022. This decision was a result of the degree of uncertainty banks face in the current environment and to ensure their balance sheets can bear the impact of the possible global market shocks.

BoE postpones stress tests – The Bank of England announced its decision to postpone its annual stress test exercise for UK banks. It said that this decision was taken to allow these banks to manage the global financial market disruption occurring due to the Ukraine-Russia conflict.

Most banks already see the effect that surging commodity prices have on their Value-at-Risk amounts. Goldman Sachs reported a significantly higher Total Value-at-Risk for Q1 2022 as commodity prices and interest rates climbed to multi-year highs. Its Commodity VaR increased by 53% over the previous quarter to USD 49 million, the highest value in over a decade. The graph above shows that their current Commodity VaR is higher than what it was even during the 2020 pandemic scenario. Similar results are reported by other banks, which have increased exposure in commodities over the last few years.

This increase in VaR numbers in the last quarter demonstrates the ramifications that the supply-chain disruptions and uncertainty in the commodities markets are having on financial institutions that trade in them. Comparable observations are visible in firms and corporate entities that are exposed to these markets too, including those within the Kingdom. This holds particularly true for those enterprises that rely on agricultural products, as these have been the most hit. The current scenario has propelled many to become cognizant of the significance of implementing operational and risk management protocols and be better equipped to tackle these situations in the future.

Enhancing Risk Management

his series of unprecedented events demonstrated that firms must employ resilient risk management strategies to protect their interests. While measures such as VaR are essential, firms must employ other strategies to increase the efficacy of risk management.

The following are areas to explore to achieve this end:

Forward-Looking Strategies – The most favored strategy for computing VaR is historical simulation. This approach involved the use of historical strategies; thus, it is backward-looking. Calculating VaR from simulated values using Monte Carlo Simulation can offer an alternative to this approach.

Stressed VaR – The Stressed VaR (SVaR) was introduced after the 2008 recession to be used to review bank’s capital requirements. The goal was to ensure and maintain enough capital to survive stressed conditions. This approach relies on historical data under stressed conditions to assess the firm’s profitability and sustainability under similar stressed conditions.

Measuring Tail Risk – Tail risk is the risk of loss under scenarios with very low probability and beyond the scope of VaR. One of the approaches to address this issue is the Expected Shortfall approach which quantifies the amounts during the worst scenarios losses.

Variance modeling – Using statistics such as Exponentially Weighted Moving Average (EWMA), which gives more weight to the recent events, acts better to calibrate the VaR model to the current market conditions.

Additionally, firms that deal with commodities can also benefit from applying risk management at the procurement end of operations. This would include updating the inventory policy, understanding the impact of commodity inflation in the supplier contracts, and ensuring that proper tools are in place to combat supply chain disruptions.

These crises the world has seen in recent times and the degree of uncertainty in the markets that followed have left many seeking clarity and striving to bring back normalcy into their operations. Unpredictable events such as these remain outside anyone’s control. They impact firms globally and have the potential for undesirable and dire consequences. Thus, they deem necessary that firms take deliberate action to ensure smooth and uninterrupted operations.