Inflation Risk

It’s fair to say that the global economic scene is not a pleasant one to watch nowadays. Corporates are penalized with severe supply shortages, soaring geopolitical concerns, cloudy economic outlook, and volatile prices across almost all asset classes. In return, we are all forced to feel this in our daily routine as economies battle one of the most aggressive inflation episodes ever witnessed. For example, looking at Turkey, April’s reading for Consumer Price Index (CPI) increased to 70% year-on-year; a compelling case for corporates to reconsider doing business in the country. In this bulletin, we will try to understand what inflation is? What can cause inflation? Explore the policy changes that can control inflation and how investors can manage it?

What is Inflation?

The winner of the 1976 Nobel Memorial Prize in Economic Sciences, Melton Freidman, once described inflation as “a dangerous and sometimes fatal disease that if kept unchecked can destroy a society”. Freidman was known for being one of the greatest monetarism advocates of all time. The textbook definition of inflation is the rate of increase in prices over a given period of time.

Inflation can be measured in various ways and methods; the most used methods are the following:

- Producer Price Indexes (PPIs): output PPI measures the average change over time in the selling prices received by domestic producers for their output. Input PPI measures the changes in the cost of the basket of purchases required as inputs into the production process.

- Consumer Price Index (CPI): a measure of the average change over time in the prices paid by consumers for a market basket of consumer goods and services. CPI is the most common across inflation measures as it calculates the broader inflation that all consumers feel.

- Personal Consumption Expenditure (PCE): instead of looking at a pre-defined basket, PCE tracks the change in prices of goods and services purchased by consumers throughout the economy over a given period. Noteworthy, the Federal Reserve’s inflation target is based on Core PCE, which takes out categories that can have severe price swings like food and energy to make underlying inflation easier to see.

As prices rise, the money you saved in the past buys you fewer goods and services today; or in other words, you lost some purchasing power. Likewise, high inflation levels could drastically erode investment returns. To account for inflation effects, investment managers often look at ‘real’ returns instead of ‘nominal’ returns. Whereby real returns are the amounts earned post adjusting for inflation. Therefore, when real returns on deposits are negative, individuals are compelled to spend rather than save and to take on riskier investments than usual. In conclusion, the effect of high inflation on real investment returns could prove destructive.

In contrast, when prices decrease over time (deflation), consumers would spend less and slow economic growth. This dilemma led economists and central banks to believe that a moderate inflation of around 2% is healthy for economic growth. Consumers are more likely to buy now than wait when prices are expected to increase. Such consumers’ behavior could fulfill economic growth aspirations.

What Can Cause Inflation?

Theoretically, inflation can be classified as demand-pull or cost-push inflation. Demand-pull inflation arises when aggregate demand increases more rapidly than aggregate supply in an economy. This type of inflation is found easier to control. It can mainly be caused by expanding economy, increased government spending, or overseas growth.

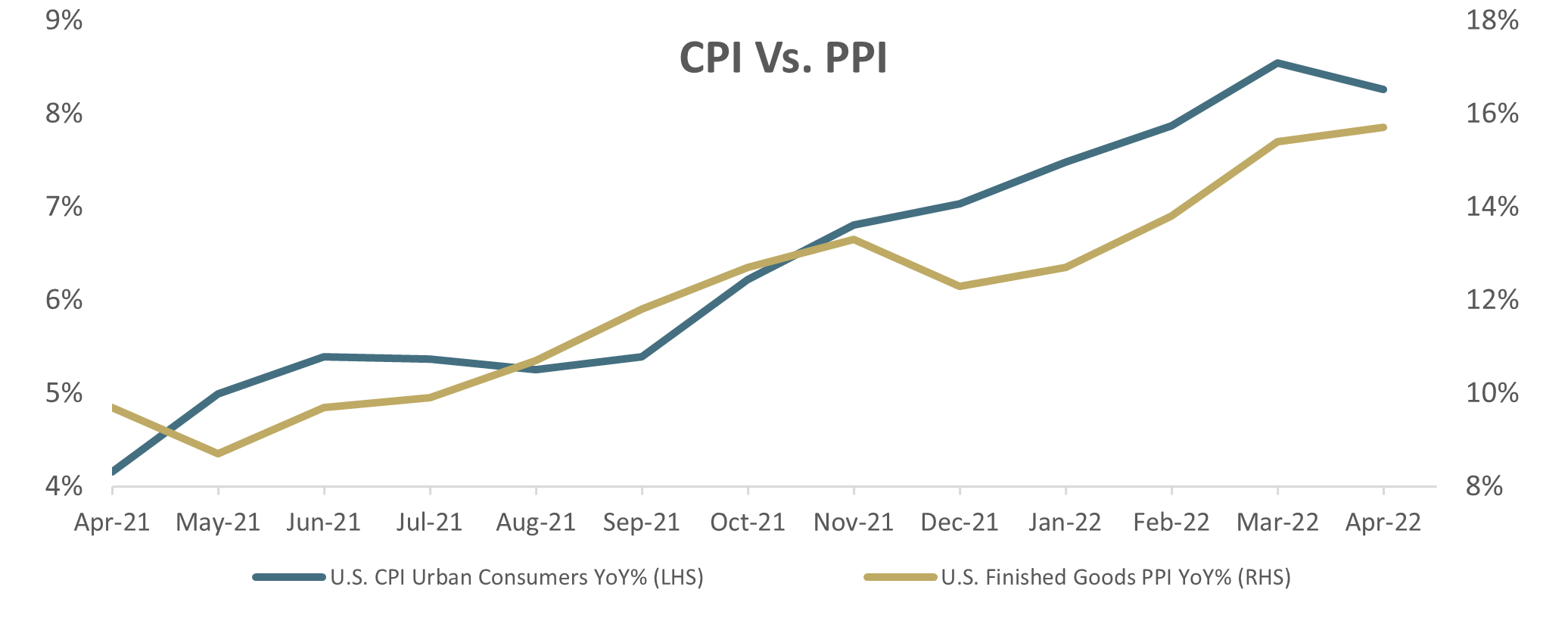

On the other hand, cost-push inflation is mainly caused by surging production costs such as raw material, labor, capital, or land. To reduce rising production costs, producers pass the increase in costs to consumers. Thus, it is reasonable to view PPI as a contributor and a leading indicator to CPI changes, especially when there is enough liquidity in the economy.

What is causing current inflation levels?

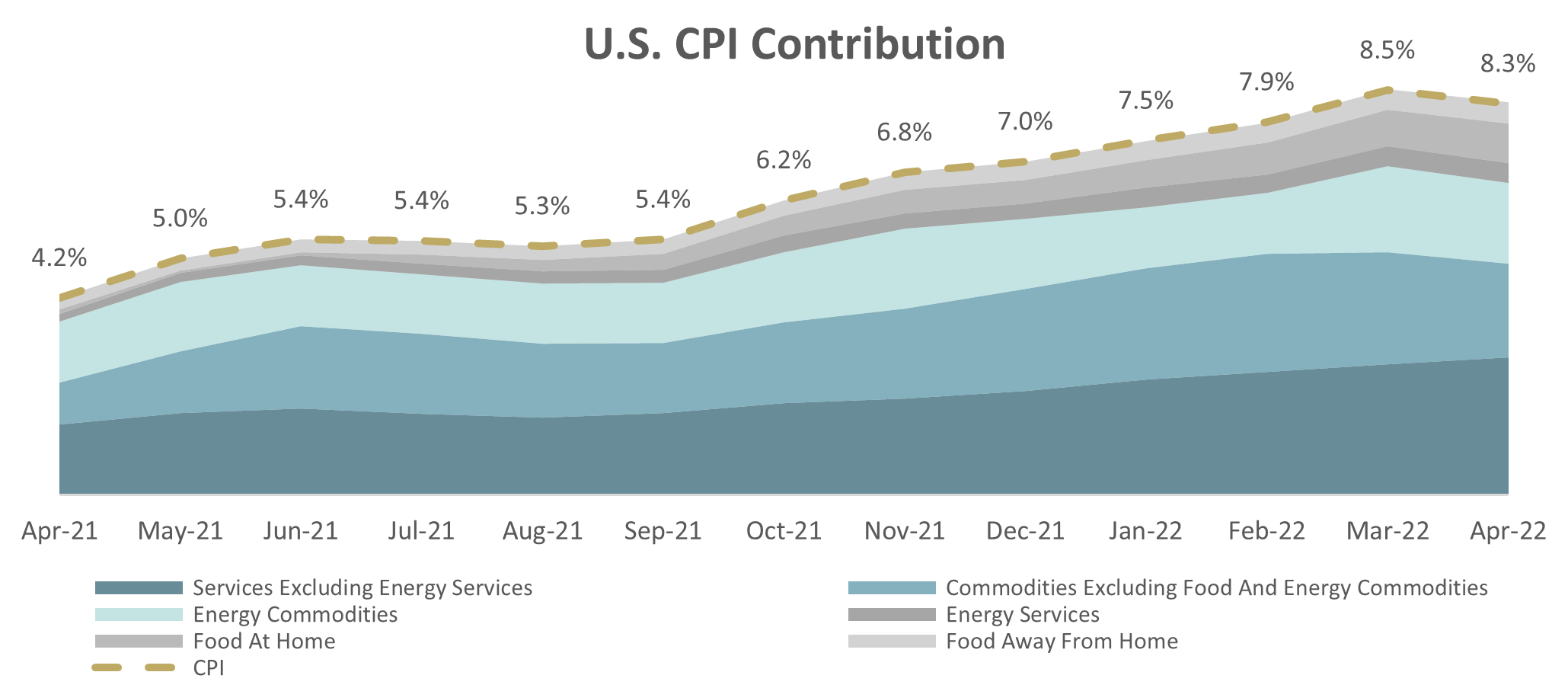

In the chart below, we break down the United States’ CPI readings into their contributions. We notice that “Commodities Excluding Food and Energy Commodities” and “Services Excluding Energy Services” accounted for more than 60% of inflation readings over the past 12 months.

But that still does not tell us if this was passed by producers or fueled by rising demand. However, when we compare the changes in United States’ CPI to PPI over the same period (chart below), we find that PPI changes were almost mirrored by CPI movements – indicating that price increases were passed by suppliers to end consumers.

Policies’ Impact on Inflation?

Governments and central banks have various tools that could tame inflation, but none is always efficient. To combat inflation, governments could implement contractionary fiscal policy by raising taxes and/or decreasing government spending to reduce the total level of spending. Nonetheless, empirical studies suggest that fiscal policy could suffer a time-lag till the policy effects are achieved. Moreover, governments could control inflation through price and wage controls. Still, this method failed to reduce long-term inflation back in 1970s. Most economists do not consider fiscal policy the best approach to combat inflation.

Moving on to monetary policies, increasing interest rates and/or reducing the money supply could both have rewarding results on inflation reduction. However, when facing cost-push inflation, higher interest rates increase the cost of borrowing and discourage consumer spending and investment. Higher rates will also tend to cause appreciation in the exchange rate, reducing the price of imported goods. This will reduce inflation but also reduce economic activity and lead to lower economic growth and potentially a recession.

This is why when there is cost-push inflation, central banks tend to allow inflation to temporarily remain high, expecting inflation will be ‘transitory’ as we have seen over the past year. When inflation-denial elapses, monetary policymakers often take desperately expedited measures to reduce inflation – realizing it might be too late to control inflation, which can shock economic growth and lead to a recession.

Inflation Hedging

Hedging inflation risk could arguably be achieved by acquiring assets that can preserve their value or generate yields higher than expected inflation. This was traditionally done through investing in real-estate and commodities. In 2022, commodity funds linked to raw materials saw rising inflows from investors looking to hedge against inflation, pushing the S&P GSCI raw materials index up by 41% YTD. Apart from traditional inflation hedging techniques, below are two of the most used instruments to hedge inflation:

- Inflation-Linked Bonds (ILBs) like the U.S. Treasury Inflation-Protected Securities (TIPS): TIPS are government-backed bonds that adjust the value of the principle according to the changes in the underlying inflation index (i.e., CPI). The TIPS spread is an actively watched spread, which shows the difference in yield between TIPS and regular U.S. Treasury securities with the same maturity. By the end of May-2022, the 5-year TIPS spread was 2.954%, meaning that inflation will need to average 2.954% over the next 5-years for TIPS to break even with a regular 5-year U.S. Treasury note.

- Inflation Swaps: Like any swap structure, inflation swap is a 2-legs swap where one party agrees to pay a fixed rate cashflow in exchange for a floating rate linked to an inflation index (i.e., CPI). In U.S. CPI swaps, for example, the floating payments will be determined by actual CPI readings while the fixed payments will be based on market implied inflation levels derived from CPI swaps curve.

Considering that TIPS carry high duration risk and significant correlation to U.S. treasury yields, inflation swaps (albeit their wide varieties in structures) are often more efficient in inflation risk management. Afterall, inflation risk can cause material damage to long term projects and is worth careful considerations and modelling.