How to Establish an Effective Interest Rate Hedge Approach

We currently live in a world of financial chaos with myriad factors beyond our control. Covid-19 still plagues some regions, constraining global supply chains. Commodities prices are going haywire as the energy crisis worsens. And central banks are raising rates at the fastest pace in decades, threatening to plunge economies into recession.

Digging deeper, you realize some factors are “known unknowns,” such as inflation skyrocketing; and we can prepare for them easily. But further complications arise when “unknown unknowns” strike! Who would have predicted the Russia-Ukraine war would break out just as the world emerged from lockdowns?

Looking at these events, it is nearly impossible to draw conclusions or determine likely outcomes. Even the most complex of financial models fail to predict black swans. This is exactly why it is disastrous to depend on market predictability in your decision-making process and your financial risk management.

Given the environment of rising central bank rates, I focus on interest rate risk management in this article. More importantly, I reveal how it is unsafe to play with the order of best practices when hedging.

A Quick SAIBOR Backdrop

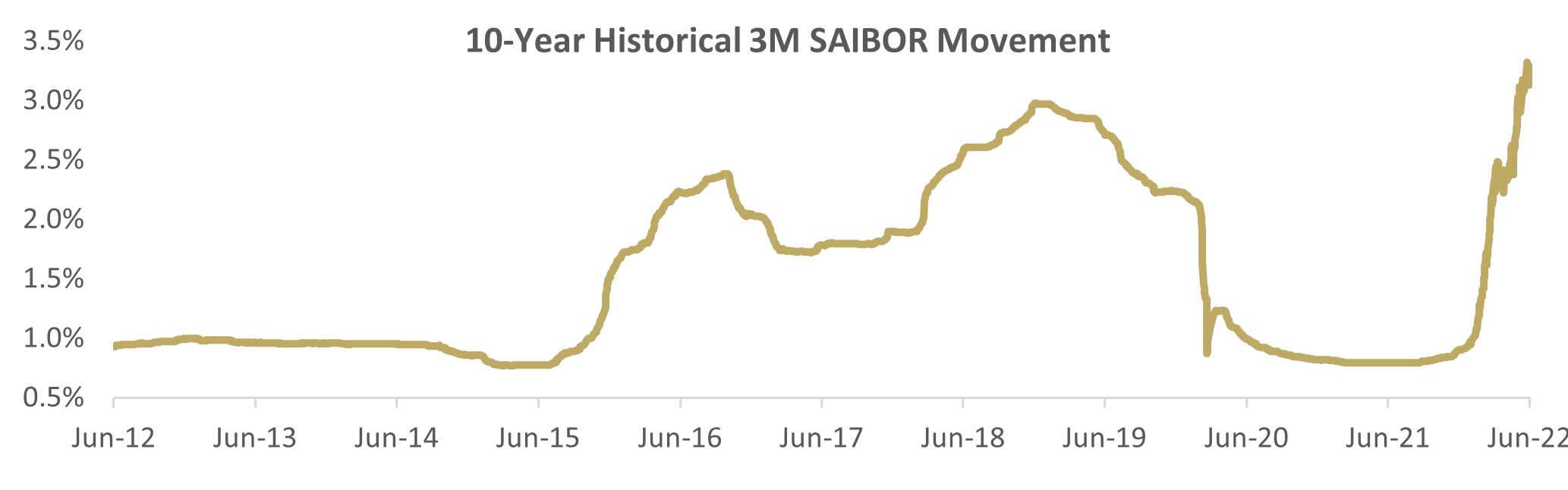

The floating interest rate index in the local market, represented by the Bahrainn Interbank Offered Rate (SAIBOR), recently crushed a new record and reached a 13-year high. While the index tracks the corresponding London Interbank Offered Rate (the LIBOR), local economic factors play a role in moving the average spread beyond the comfort zone. Hence, the 3-Month SAIBOR reached 3.32% on 20th June 2022, while the LIBOR counterpart traded at 2.12% during the same day. This represents a spread of 120 basis points (1.20%) versus the 10-year average of only 63 basis points (0.63%). The current spread is getting closer to historical averages.

Until very recently, to hedge a 5-Year loan via an Interest Rate Swap, the fixed cost was north of 4.40%, which remarkably increased from below 1.5% in 2020! These record numbers are attributed to a more aggressive Fed and expected rate hikes in the future.

Creating and endorsing an internal approach or framework to manage the interest rate risk is not a difficult task. But making it implementable and objective requires collective efforts among various stakeholders within the institution. Below are high-level guidelines.

A. Identify Your Exposure

The first step is documenting the items exposed to interest rate risk. It does not matter if the underlying is borrowing or investment. This process is also forward-looking, meaning you must factor in projected or highly probable transactions.

Certain core elements are involved in the identification stage. The company must examine its risk policy and appetite, understand the net position of the exposure, and remember the financial covenants or KPIs in place.

B. Measure, Analyze, and Determine the Effects of the Risk

You have the exposure at hand now and are ready to quantify its impact. One of the common traps here is to apply quantitative assessments strictly and ignore the qualitative aspects.

Quantitative methodologies include using risk metrics to understand the magnitude of the risk, such as Historical Simulation of Value-at-Risk (VaR), sensitivity assessment, scenario analysis, and Monte Carlo Simulation. These methodologies not only indicate how much loss you should expect in bad times but also reveal the flipside of the coin: the opportunities these fluctuations hold.

Yet such quantitative analysis lacks meaning without proper contextualization. Qualitative assessment and expert judgment play a role in understanding the company’s direction when managing the risk. Together, the two methodologies eventually teach us how significant or insignificant the exposure is relative to the KPIs and the company’s objectives.

Companies must measure the impact of interest rate risks against the KPIs and/or the covenants. Doing so would provide an overall picture of how to manage the risk according to the risk profile.

C. Control the Risk

Now is the time for action – dealing with the identified risks at hand. A vast array of approaches exists to control interest rate risks. They are not just restricted to off-balance sheet hedges. You can use on-balance sheet hedges to manage the risk via different techniques such as asset and liability management (ALM) or offsetting one exposure with another. An off-balance sheet hedge approach could utilize financial derivatives, which many corporates apply. However, this requires a holistic understanding of the associated accounting and economic implications.

Notably, “controlling” the risk does not necessarily mean taking action to control it. It includes avoiding it altogether, mitigating it, or accepting it.

D. Monitor and Report the Risk

This is the only stage where we know whether the risk management activities have been practical and effective.

All related stakeholders should be involved in the process across the management levels. There must be clear accountability and risk owners to enhance the feedback loop and supervise the effectiveness of the current risk management tools. It involves communication, which should also be present in all the stages above.

It is nearly impossible to create a standardized risk management approach and neither dynamically alter nor optimize it. Therefore, the process will evolve to become more efficient and tackle emerging risks. This adjustment process aims to bridge the gap between the actual result and the required output.

The board of directors and senior management rely on the report to assess the levels of risk, map it against the risk profile and evaluate the effectiveness of the current practices. Hence, assessing against quantifiable, relevant, critical, and timely KPIs is key to successful risk reporting, which would ultimately lead to a better and informed decision.

The Last Word

Risk management decisions must occur in the correct framework and context. Otherwise, the outcome from basing the decision on non-controllable factors will prove, sooner or later to be suboptimal.

Once the institution insulates itself from subjective decision-making and complies with clear guidelines and best practices, it can produce clear, unbiased, and objective outcomes with lasting impact.

The art of financial risk management does not lie solely in establishing the correct policy and procedures. It also lies in ensuring they are implementable with a clear accountability matrix. Attaching emotions or market forecasting will, inevitability, destroy the essence of proper financial risk management and hedging practices in any organization.