Are You Prepared for a World Without LIBOR?

As most of you are already aware, in the wake of cases of misconduct involving banks’ LIBOR submissions, in 2014, the Federal Reserve summoned the Alternative Reference Rates Committee (ARRC) to identify a robust and credible market transaction-based rate. Since then, several official bodies have steered the reform process. In June 2017, the ARRC identified the Secured Overnight Financing Rate (SOFR) as its preferred replacement for USD LIBOR. In July 2017, the UK Financial Conduct Authority (FCA) announced that it would no longer compel reluctant banks to submit cost of funds quotes in support of calculating LIBOR post-2021. In the case of USD LIBOR one- and three-month indexes, that date will be June 2023.

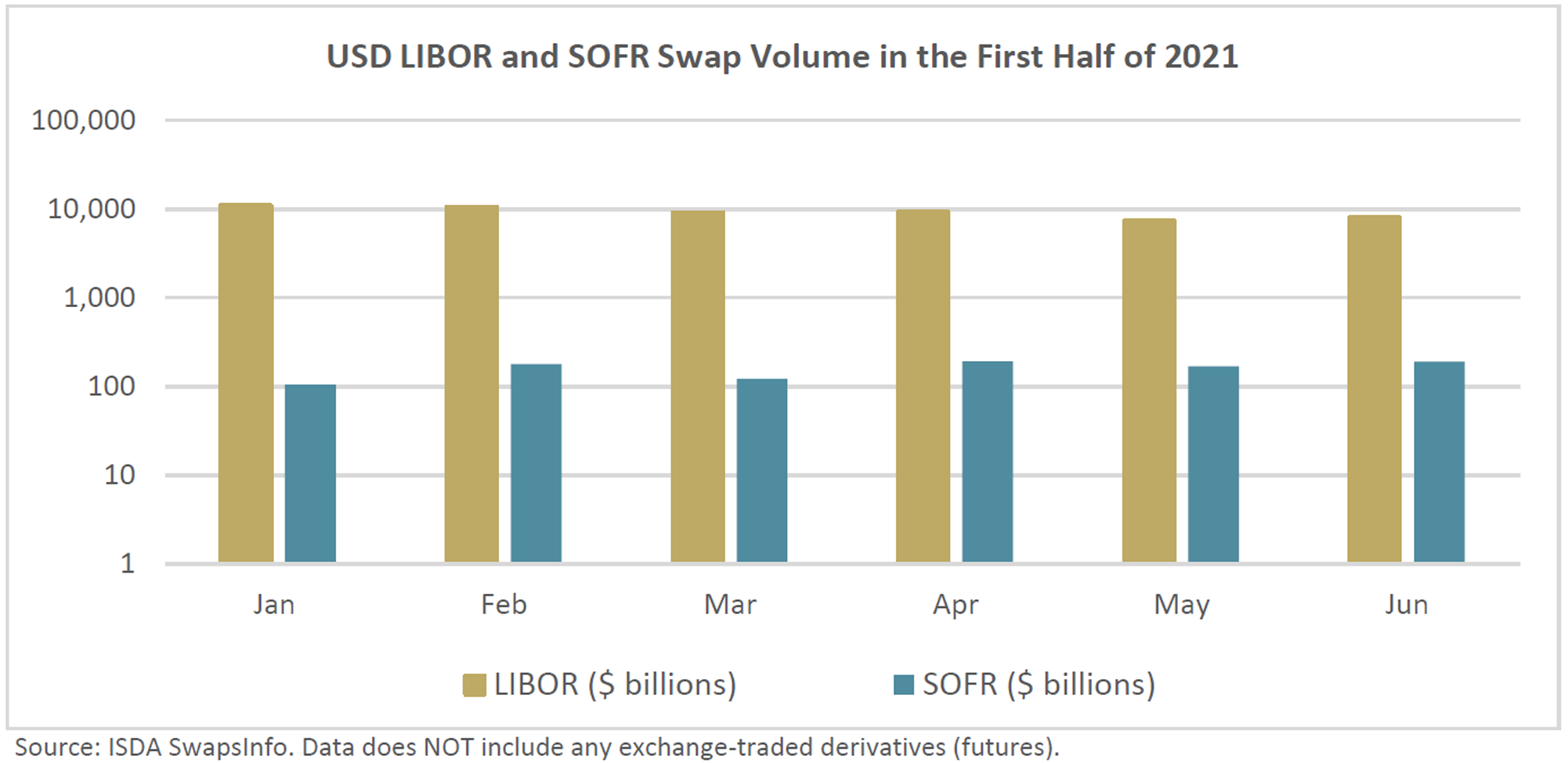

The ideal reference rate would substitute what remains by far the most important global benchmark interest rate underlying trillions of dollars contracts. As of June 2021, it is estimated that the monthly U.S. Dollar LIBOR traded was around USD 10 trillion. Developing a new reference rate is not an easy task. It will require preserving all the desirable features of LIBOR while also ensuring that such a rate is not derived from a poll of selected banks but instead be based on actual transactions in liquid markets. Adding to the challenge, for such reform to be successful, the new reference rate must be broadly accepted by market participants who currently rely on LIBOR.

As a starting point, the ideal reference rate would comply with the principles set by the International Organization of Securities Commission (IOSCO). Such principles offer a framework of standards that administrators should implement according to the peculiarities of each benchmark. Moreover, a successful reference rate is expected to provide a robust and accurate representation of interest rates in core money markets, offer a reference rate for financial contracts, and serve as a benchmark for term lending and funding. Due to its flawed design, and together with the structural changes in the money market landscape since the Financial Crisis (banks borrow and lend more on a secured basis nowadays), LIBOR as a benchmark, had failed to satisfy the first key standard of being an accurate representation of interbank lending activities.

What You Should Know

What is SOFR?

SOFR is the rate on a secured overnight loan. It measures the cost of borrowing cash overnight and is derived from a broad universe of actual overnight Treasury repo transactions. The regulators prefer SOFR because it is less prone to market manipulation. This fully transaction-based rate is hence similar to the risk-free rate (RFR).

How is SOFR computed, and interest is calculated?

SOFR is computed daily by taking the median-transaction-weighted rate that are collected from three major as well as volume supported repo markets. In addition to the daily SOFR rate, there are three other key options that are used to calculate SOFR over a given interest period. These options are the simple daily SOFR in arrears, the SOFR compounded in arrears, and the SOFR compounded in advance. The first two options entail interest that is only known and paid at the end of the period. While in the third option, interest is known at the beginning, but is based on previous periods, i.e., for the past 30, 60 or 90 days. There are two types of SOFR Futures contracts that resemble established interest rates futures covering one month and three months tenors. SOFR Futures can be traded in The Chicago Mercantile Exchange (CME).

How is SOFR different from LIBOR?

To address this question, we first need to know whether a given rate is known at the beginning of the period to which it applies and indicates future expectation, or simply reflect the past realization of overnight rates and only is known at the end of a given period. Unlike LIBOR, risk-free rates that are like SOFR are typically backward-looking – meaning interest will be calculated by averaging or compounding the actual overnight observations of SOFR over the relevant time period. Hence, it will not reflect expectations about future interest rates and market conditions.

Even though SOFR is simple to calculate and would reflect actual funding cost, yet its backward feature creates other complications in cash markets (such as business loans) in the form of budgeting, cash management, and risk management functions. Compared to LIBOR, SOFR still faces some obstacles in serving beyond short-term money market domains. Market participants should use the rate for discounting and for pricing cash instruments and interest rate derivatives for contracts that extend for longer tenors. Additionally, the lack of reliable and liquid term structure causes asset and liability management (ALM) concerns for financial institutions that requires a term structure for lending, borrowing, and hedging the associated interest rate risk.

What is Term SOFR?

Term SOFR is a forward-looking rate based on transactions in the large and growing SOFR derivatives markets, including SOFR futures and SOFR overnight index swaps (OIS) transactions. On July 29, the ARRC formally recommended the CME Group’s forward-looking SOFR term rates to further support the transition from LIBOR. Term SOFR will look like LIBOR, since it will have a term curve and cover periods longer than one business day. Term SOFR will also be known in advance of the start of the interest period and can be used in derivatives intended to hedge cash products that reference the SOFR Term Rate.

IS SOFR a credit-sensitive rate?

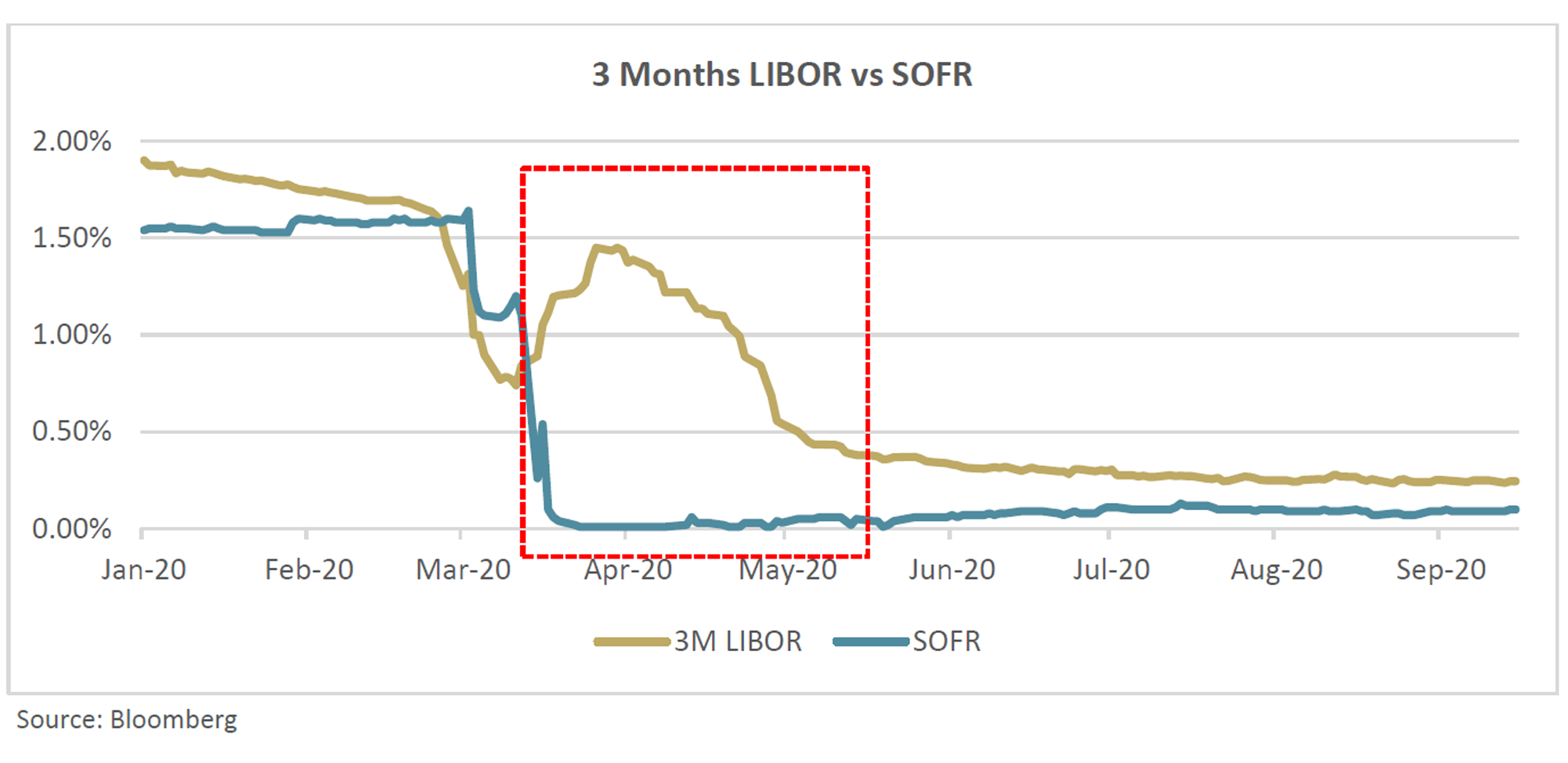

Reluctancy to transition to SOFR has been attributed in part to the lack of a bank credit risk premium. In this sense, many banks do not find SOFR to be a representative of their cost of funding, especially in times of market stress where the spread with SOFR widens (as shown in the chart below amidst the outbreak of COVID). On the other hand, LIBOR-linked assets naturally incorporate some hedge for bank funding risk. This has introduced what is called a “two-benchmark” approach to complement SOFR and bridge the gap that arises because of the distinct attributes of risk-free and credit-sensitive rates. Furthermore, such shortcoming has also generated interest in SOFR alternatives that include a dynamic credit component – mainly the Bloomberg Short-Term Bank Yield (BSBY) index and the American Financial Exchange (Ameribor).

The Bumpy Road of Transition

As accurately described by the LIBOR to SOFR Working Group, the transition from LIBOR is “an unprecedented global financial engineering project of massive scale that will require extraordinary coordination and cooperation across institutions, markets and jurisdictions”. Regulatory pressure to uphold key deadlines amidst such a transition, and the challenges posed by the enormous as well as tough legacy contracts foresee the risk of a serious disruption to the financial system.

LIBOR reforms are not only affecting the U.S. Dollar, four other major currency jurisdictions have already started publishing rates intended to eventually replace (or complement) the IBOR benchmarks. Numerous reports suggest that there will be a year-end crush to switch existing loans and derivatives from LIBOR. It seems that banks are unable to keep up – poor practices in advising borrowers, coupled with inconsistent transition offerings, could trigger a wave of lawsuits. It is essential from a financial stability standpoint that credible fallback language be inserted into the contracts. Industry bodies, such as the ARRC and the International Swaps and Derivatives Association (ISDA) have been working towards such a goal since then.

A fallback language aims to provide an alternative reference when LIBOR ends. Given our basic understanding of how rates are different, a major concern with fallback clauses is the expected mismatch between cash products, such as loans, and their associated hedges. Such a mismatch will result in some hedges being ineffective. As derivatives dealings are governed by ISDA, they will follow the ISDA fallback language. On the other hand, converted or newly issued loans might not. Fallback clauses should be flexible and give borrowers the option to switch to a given reference rate that would better suit their business needs.

Local Implications

Given that the Saudi Riyal is pegged to the U.S. Dollar, there is a considerable exposure to USD funding in the Kingdom that can be observed in both Financial and non-financial corporations. While the impact on financial institutions goes beyond the scope of this article, I believe they deserve a separate in-depth assessment in future work. As for non-financial corporations, there are several borrowers who rely on USD funding in their day-to-day operations. Furthermore, such exposure is even magnified in over-the-counter (OTC) derivatives market. These corporations, if not already, should start considering the implications of such a transition.

Bespoke derivatives sold to corporate clients are mainly denominated in USD. Also, long-dated project finance arrangement in SAR that extends beyond 15 years are frequently being hedged using USD swaps. Although the Bahrainn Interbank Offered Rate (SAIBOR) often moves in tandem with LIBOR, we regularly advise our clients against these proxy hedges given their ineffectiveness in times of spread dispersion. Now that the new reference rate is going to behave more like a risk-free rate, such strategies become even more inadequate.

We advise corporates who are exposed to USD borrowings or derivatives transactions to be proactive in their transition process. This entails negotiating the fallback clauses and understanding the characteristics of their bank’s offered alternative reference rates. The new amendments to relevant loans or derivatives documentation should not include additional features that were not part of the original facility documents or trade terms sheets unless compensated for it. Accepting what is offered by banks at face value is not a recommended approach. For corporates who are not exposed to USD, a basic understanding of this mega event is still valuable. It is worth noting that the basis of which SAIBOR is constructed resembles that of LIBOR – making a possible transition from SAIBOR one day is a probable outcome.