The Desperate Hunt for Yield: Structured Deposits Explained

Since the Global Financial Crisis hit markets worldwide, central banks have injected trillions of dollars into vulnerable economies and offered unlimited monetary support. Covid-19 saw them shift into overdrive, and despite inflation concerns, the ultra-low interest rate environment still dominates.

In such a scenario, investors and institutions who invested funds into fixed-income asset classes and short-term fixed deposits saw their yields decline dramatically. Pressured by return hurdles, they are increasingly adopting more creative solutions to achieve their return aspirations – even if this means reassessing the risk appetite framework.

In this article, we shed light on the structured deposit products that recently attracted some popularity in the local market (most aspects covered here also apply to the structured notes in general). And we ask, are they too risky?

What Is a Structured Deposit, and How Is It Different from a Fixed Deposit?

A fixed deposit is where the investor invests money for an agreed period with a pre-determined return. The return closely follows the prevailing interest rates in the market with a typically extended duration of up to a year.

A structured deposit is a mix between a deposit and an investment product bundled into one. Its return is directly linked to the investment product’s performance, offering the potential of a higher return versus a fixed deposit. Structured deposits also let you build customized risk and return attributes (e.g., gaining exposure to a chosen currency basket). However, investors should carefully assess the contingent risks to make an informed decision.

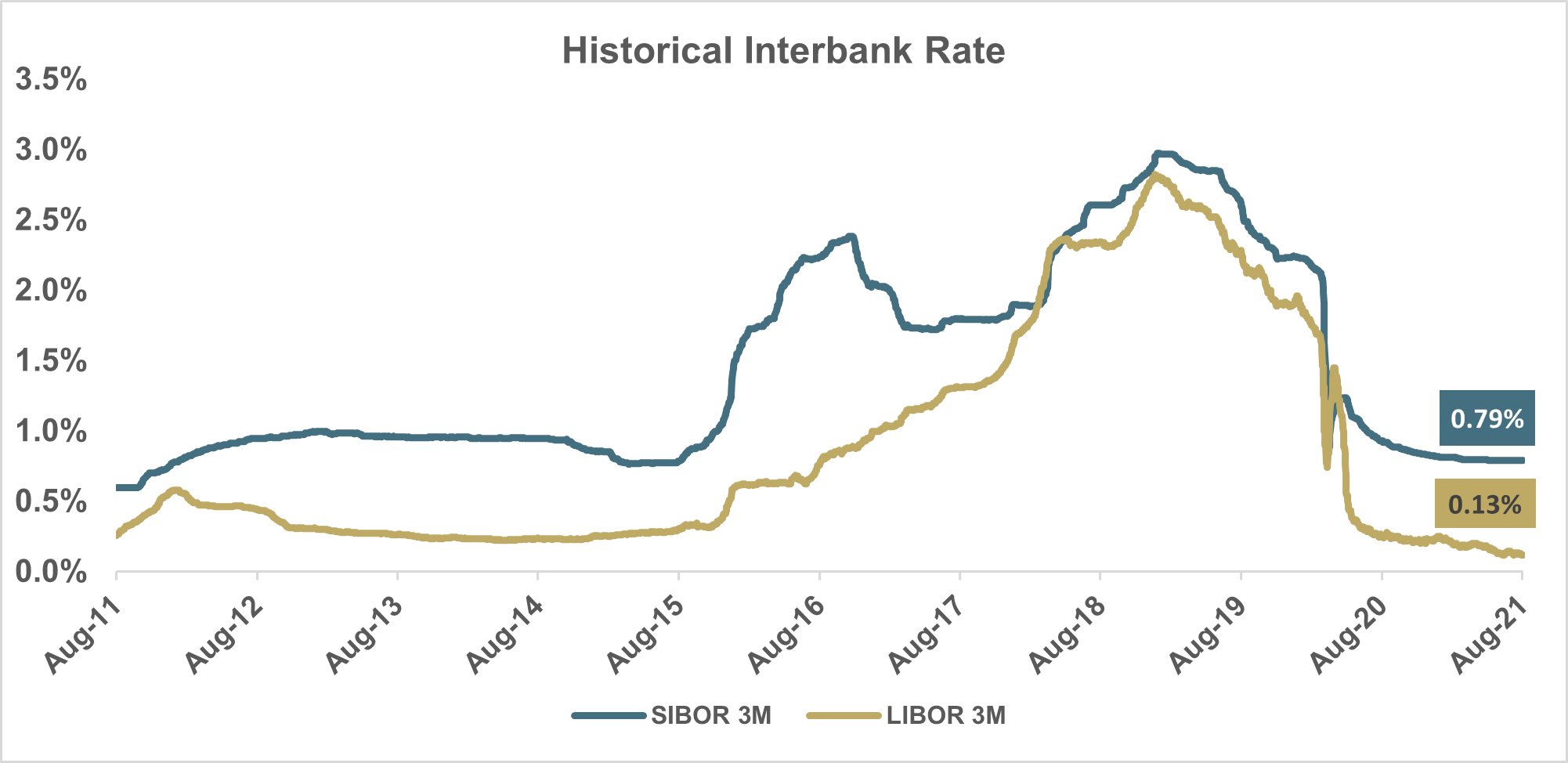

The structured deposit duration usually extends beyond one year to achieve the aspired return, especially in the current low interest rate environment. On average, it ranges between three to five years. The Bahrainn Interbank Offered Rate (SAIBOR) has remained low for an extended period now (see chart), along with the corresponding USD London Interbank Offered Rate (LIBOR). Such a low interest rate environment pushes investors to hunt for better yields elsewhere, even if assuming more risks.

The investment product attached to the structured deposit can be tailored and structured with any asset class. Hence, the deposit’s return could be linked to the performance of equity (or an equity index), interest rates, foreign exchange, or even commodities. Given the diverse universe of financial derivatives, financial institutions have an ocean of options to offer investors. For example, the investor could enter into a 3-Year deposit that returns a group of equities’ performance without physically buying them directly. Often, the capital will be protected if held till maturity.

If this sounds too good to be true, you are onto something! Let us dig into more details.

Structured Deposit Considerations

Can I break my structured deposit before maturity?

You can break a regular fixed deposit anytime (with minimal charges, if any). But you must consider more when breaking a structured deposit. For example, you might incur significant charges, especially if the linked investment product performed unfavorably. In some instances, prepare to accept losses on the principal invested.

How can I properly assess the risk-reward trade-offs?

Always consider reinvestment risk. Sometimes, the financial institution selling the structured deposit product has a right to “call” the product (i.e., cancel the structured deposit) and return the money to the investor. This only happens when the investment becomes favorable to the investor. The rationale behind embedding such a “callability” feature is to attain better economic terms on the structured deposit itself.

You should also assess the “capped return risk”. Beware scenarios where your returns are capped at a certain threshold. In this case, you are better off investing the funds in the underlying asset itself (e.g., equity or a currency basket) rather than synthetically implementing the strategy via the structured deposit.

Is my investment liquid? How easily can I run a valuation?

One critical aspect is to navigate and assess the structured deposit’s liquidity. Most structured deposits represent a synthetic exposure to the assets via financial derivatives. Hence, liquidity remains a core element in analyzing the prospect of liquidating the investments, especially at times of crises when liquidity disappears. This calls for running a pre-emptive liquidity analysis, where different stressing tools and robust statistical techniques are utilized.

Another critical consideration is valuations. Since such investments embed derivatives, valuations may vastly differ across institutions depending on their valuation methodologies and pricing models. Accurately valuing the investment daily is challenging, so exert special consideration here.

How can I ensure I am getting the best executed structured deposit?

Information asymmetry between the investor and the structured deposit provider (the financial institution) creates a knowledge gap. And that potentially produces suboptimal implicit execution charges. The investment product bundled with the deposit is most likely a financial derivative that could obscure the structured deposit’s pricing. Such pricing complexity may tempt providers to generate income margins beyond commercially reasonable standards.

Can I accurately predict my investment coupons?

The short answer is no. Prepare to accept variability in the periodic returns that structured deposits generate. Unlike fixed deposits, where coupons are fixed in advance, the periodic returns/coupons for structured deposits depend on the performance of the underlying investment product linked to the deposit. While the potential coupons are potentially much higher than fixed deposits, they can also be zero if the underlying asset performs poorly.

Conclusion

Whether a retail or corporate investor, you must consider the overarching investment objectives and constraints when investing in a structured deposit. The commercial terms and conditions contain important information that you must read and analyze. The investor should account for providers amplifying the product’s positive attributes while deemphasizing its shortcomings.

As mentioned, pricing and valuing such products is complex due to the nature of the embedded derivative instrument(s). Align your risk tolerance and appetite with what the structured deposit offers.

Hence, make sure you can objectively assess the underlying assets embedded in your structured deposit; that could vastly help you understand the investment risk profile and ensure you attain the best execution experience. Tax and accounting implications also deserve full attention before considering such a multi-year investment.

Finally, amid the overwhelming offered structured deposits and investment solutions, you should take one step back, capture the big picture, and prioritize objectivity in making the decision. For example, the structured deposit’s linked asset class should be aligned with the overall risk management strategy (i.e., a company might enter into a commodity-linked structured deposit to partially offset the impact of soaring raw material commodity price). In this case, adhering to risk management aspects alongside the financial aspirations helps in achieving long-term success.